In the fast-paced and ever-changing world of entrepreneurship, staying on top of your game is essential. Good record keeping plays a vital role in the overall success of your small business. From financial management and tax purposes to future planning, maintaining detailed records ensures that you have a clear understanding of your business’s financial health, helps you make informed decisions, and keeps you compliant with necessary regulations. As you navigate the ups and downs of the business world, remember to stay focused, be patient, and be willing to make tough decisions when necessary. Seek help and advice when needed, and always be ready to adapt and innovate to stay ahead of the competition. By following these key principles, you’ll increase your chances of long-term success and financial stability.

Financial Management

Tracking Income and Expenses

Tracking your income and expenses is a fundamental aspect of financial management. By accurately recording all incoming and outgoing funds, you can gain a clear understanding of your business’s financial health. This allows you to identify areas of growth, as well as areas where costs can be reduced. Keeping track of your income and expenses also enables you to monitor cash flow effectively, which is essential for ensuring that you have enough funds to cover your business’s ongoing expenses.

Monitoring Cash Flow

Monitoring cash flow is crucial for the sustainability of any business. Cash flow refers to the movement of money in and out of your business, and it determines your ability to meet your financial obligations. By closely monitoring cash flow, you can identify any potential cash shortages or surpluses in advance and take proactive measures to address them. This includes managing your inflows and outflows, negotiating better payment terms with suppliers, and implementing strategies to speed up customer payments.

This image is property of marcuslemonis.com.

Analyzing Profitability

Analyzing profitability is an important aspect of financial management that allows you to assess the overall financial health and viability of your business. It involves evaluating your business’s revenue and expenses to determine its profitability. By analyzing profitability, you can identify areas where costs can be reduced, revenue can be increased, or pricing strategies can be adjusted. This analysis helps you make informed decisions that contribute to the growth and success of your business.

Forecasting Financial Performance

Forecasting financial performance involves making predictions about your business’s future financial outcomes based on historical data and market trends. This allows you to anticipate potential risks and opportunities and develop strategies to mitigate or capitalize on them. By forecasting your financial performance, you can make more accurate budgetary decisions, set realistic goals, and allocate resources effectively. It also helps you identify potential financing needs and plan for future growth and expansion.

Tax Purposes

This image is property of marcuslemonis.com.

Complying with Tax Regulations

Complying with tax regulations is essential for every business to meet its legal obligations and avoid penalties. By keeping accurate and up-to-date financial records, you can ensure that you are properly reporting your income and expenses, filing the required tax forms, and paying the appropriate taxes. Failure to comply with tax regulations can result in severe consequences for your business, including audits, fines, and legal issues.

Maximizing Deductions

Maximizing deductions is an important strategy for minimizing your tax liability and maximizing your business’s profitability. By keeping detailed records of your expenses, you can identify eligible deductions that can offset your taxable income. This includes expenses such as rent, utilities, office supplies, and business-related travel. By taking advantage of all available deductions, you can lower your tax burden and keep more money in your business.

This image is property of marcuslemonis.com.

Preparing Accurate Tax Returns

Preparing accurate tax returns is essential for avoiding any discrepancies or errors that could trigger an audit or other legal issues. By maintaining detailed and organized financial records, you can provide the necessary documentation to support the information reported on your tax returns. This includes keeping track of income, expenses, receipts, and invoices. By preparing accurate tax returns, you can demonstrate your commitment to tax compliance and minimize the risk of penalties or audit.

Reducing the Risk of Audits

Keeping accurate and organized financial records significantly reduces the risk of audits. Audits involve a thorough examination of your business’s financial records and can be time-consuming, costly, and disruptive to your operations. By maintaining good record keeping practices and complying with tax regulations, you can demonstrate transparency and minimize the likelihood of an audit. This includes keeping copies of all relevant financial documents, such as bank statements, invoices, and receipts.

Future Planning

This image is property of marcuslemonis.com.

Setting Realistic Goals

Setting realistic goals is a crucial part of future planning for your business. By establishing clear and achievable objectives, you can create a roadmap for success and measure your progress along the way. Your goals should be specific, measurable, attainable, relevant, and time-bound (SMART). This allows you to stay focused and motivated, and ensures that you are directing your resources towards the most impactful activities.

Budgeting and Cost Management

Budgeting and cost management are essential components of future planning. By creating a budget, you can allocate your resources effectively and plan for future expenses and investments. This includes forecasting your income and expenses, prioritizing your spending, and monitoring your actual versus projected financial performance. Implementing cost management strategies, such as negotiating better terms with suppliers, can also help you optimize your business’s financial resources and achieve your goals.

This image is property of marcuslemonis.com.

Securing Financing

Securing financing is often necessary for businesses to fund their growth and expansion plans. By maintaining good financial records and demonstrating profitability, you can enhance your credibility and increase your chances of obtaining financing from lenders and investors. This includes preparing accurate financial statements, such as balance sheets and income statements, that provide a comprehensive overview of your business’s financial health. Securing financing allows you to capitalize on growth opportunities and invest in the future success of your business.

Identifying Growth Opportunities

Future planning involves identifying growth opportunities and capitalizing on them. By analyzing market trends, customer preferences, and industry developments, you can position your business for long-term success. This includes conducting market research, monitoring your competition, and exploring new product or service offerings. By staying informed and adaptable, you can identify and seize opportunities that enable you to achieve sustainable growth and stay ahead of the competition.

Importance of Good Record Keeping

Avoiding Financial Chaos

Good record keeping is essential for avoiding financial chaos in your business. By maintaining accurate and up-to-date financial records, you can easily track your income, expenses, and cash flow. This allows you to have a clear overview of your business’s financial health and make informed decisions. Without proper record keeping, you risk losing sight of your financial situation and may face challenges in managing your business effectively.

Building Credibility with Lenders and Investors

Good record keeping builds credibility with lenders and investors, which is crucial for securing financing and attracting investment. When seeking funding or partnerships, potential lenders and investors rely on accurate and comprehensive financial information to evaluate the risk and potential return of their investment. By maintaining good records, you can provide a transparent and trustworthy picture of your business’s financial health, increasing your chances of obtaining the necessary funding or partnership.

Maintaining Transparency

Transparency is essential for maintaining trust and confidence in your business. By keeping detailed and organized financial records, you can demonstrate transparency to your stakeholders, including employees, customers, suppliers, and regulatory authorities. This includes providing accurate financial statements, such as profit and loss statements and balance sheets, and promptly addressing any discrepancies or concerns. By maintaining transparency, you can enhance your reputation and foster strong relationships with your stakeholders.

Making Informed Business Decisions

Good record keeping allows you to make informed business decisions based on accurate and up-to-date financial information. By having a clear overview of your business’s financial health, you can evaluate the potential impact of different decisions on your profitability, cash flow, and overall financial performance. This includes assessing the feasibility of new investments, pricing strategies, and cost management initiatives. By making informed decisions, you can optimize your business’s financial resources and increase your chances of success.

The Consequences of Poor Record Keeping

Legal and Regulatory Issues

Poor record keeping can result in legal and regulatory issues that can significantly impact your business. If you fail to maintain accurate and up-to-date financial records, you risk violating tax regulations, employment laws, and other legal requirements. This can lead to penalties, fines, legal disputes, and damage to your business’s reputation. By adhering to good record keeping practices, you can avoid these consequences and ensure that your business operates within the boundaries of the law.

Inaccurate Financial Reporting

Poor record keeping can result in inaccurate financial reporting, which can distort your business’s financial position and performance. Inaccurate financial reporting can mislead stakeholders, including lenders, investors, and regulatory authorities, and damage your business’s credibility and reputation. By maintaining accurate and detailed financial records, you can generate reliable financial reports that provide an accurate representation of your business’s financial health. This enhances transparency and facilitates better decision-making.

Missed Tax Deductions

Poor record keeping can result in missed tax deductions, leading to higher tax liabilities for your business. Deductions, such as business-related expenses, can significantly reduce your taxable income and lower your overall tax burden. Without proper record keeping, you may overlook eligible deductions and end up paying more in taxes than necessary. By keeping detailed records of your expenses and maintaining accurate financial statements, you can identify and claim all eligible deductions, maximizing your tax savings.

Financial Instability and Failure

Poor record keeping can ultimately lead to financial instability and business failure. Without accurate and up-to-date financial records, you may struggle to effectively manage your cash flow, monitor your profitability, or make informed business decisions. This can result in financial losses, an inability to meet your financial obligations, and overall business failure. By prioritizing good record keeping practices, you can enhance the financial stability and long-term success of your business.

The Role of Technology in Record Keeping

Accounting Software and Tools

Accounting software and tools play a crucial role in efficient record keeping. These software solutions automate various accounting tasks, such as bookkeeping, invoicing, and financial reporting, saving you time and reducing the risk of errors. Accounting software also provides real-time visibility into your business’s financial health, allowing you to make informed decisions based on accurate and up-to-date information. There are many accounting software options available, ranging from simple applications for small businesses to robust platforms for larger enterprises.

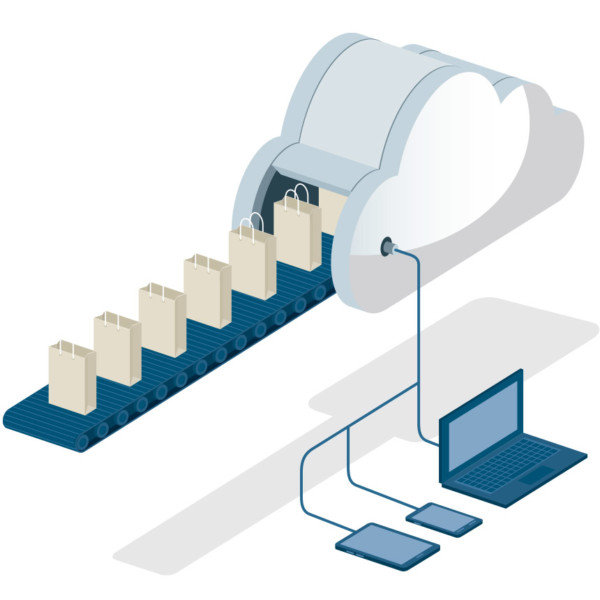

Cloud-Based Storage and Backup Solutions

Cloud-based storage and backup solutions offer secure and convenient options for storing and protecting your business’s financial records. These solutions allow you to store your files and documents online, eliminating the need for physical storage and reducing the risk of loss due to theft, fire, or other unforeseen events. Cloud-based storage also enables you to access your financial records from anywhere at any time, providing flexibility and convenience. Backing up your records regularly ensures that you have a reliable and up-to-date copy in case of data loss or system failures.

Automation of Administrative Tasks

Automation of administrative tasks, such as data entry and report generation, helps streamline record keeping processes and improve efficiency. By automating repetitive and time-consuming tasks, you can free up your time to focus on more strategic activities. Automation also reduces the risk of errors and ensures that your financial records are consistently accurate and reliable. There are various software and tools available that can automate administrative tasks, allowing you to optimize your record keeping efforts.

Integration with Financial Institutions

Integration with financial institutions, such as banks and credit card companies, simplifies record keeping by automatically importing and categorizing transactions. By integrating your accounting software with your financial institutions, you can eliminate manual data entry and ensure that your financial records are always up to date. This integration also provides a real-time overview of your cash flow and helps identify any discrepancies or issues that need to be addressed. Many accounting software solutions offer seamless integration with popular financial institutions for a streamlined record keeping process.

Conclusion

Achieving financial success and stability requires effective financial management, good record keeping, and future planning. By tracking your income and expenses, monitoring cash flow, and analyzing profitability, you can make informed decisions that contribute to the growth and success of your business. Complying with tax regulations, maximizing deductions, and preparing accurate tax returns are essential for minimizing risk and ensuring legal compliance. Setting realistic goals, budgeting and cost management, securing financing, and identifying growth opportunities enable you to plan for the future and position your business for long-term success.

Good record keeping is of paramount importance throughout all aspects of your business. It helps you avoid financial chaos, build credibility with lenders and investors, maintain transparency, and make informed business decisions. Poor record keeping, on the other hand, can lead to legal and regulatory issues, inaccurate financial reporting, missed tax deductions, and financial instability. By leveraging technology, such as accounting software, cloud-based storage, and automation, you can streamline your record keeping processes and enhance efficiency.

In conclusion, by prioritizing financial management, tax compliance, future planning, and good record keeping, you can position your business for sustainable growth, financial stability, and long-term success in today’s competitive business landscape.

Source: https://marcuslemonis.com/business/small-business-success