Looking to boost your earnings? Look no further! This article has got you covered with 37 fantastic ideas to make ,000 a week. Whether it’s starting a blog for some long-term side hustle action or participating in paid surveys and focus groups, there are plenty of ways to earn extra money. And don’t forget about becoming a virtual assistant or working as a freelancer. But the fun doesn’t stop there! You can also supercharge your earnings by using cashback apps, collecting sign-up and referral bonuses, and even investing and budgeting for long-term financial growth. So what are you waiting for? Let’s dive right in and explore all the potential ways to make those dollars!

This image is property of www.brooksconkle.com.

Plan and Budget for Earnings Growth

Track Your Expenses

To effectively plan and budget for earnings growth, it’s crucial to first understand your current financial situation. Start by tracking your expenses. This means keeping a record of every dollar you spend, whether it’s on groceries, bills, entertainment, or any other expense. Use a spreadsheet or a budgeting app to categorize your expenses and calculate the total amount spent each month.

Set Financial Goals

Once you have a clear understanding of your expenses, it’s time to set financial goals. Ask yourself what you want to achieve in terms of earnings growth. Maybe you want to save for a down payment on a house, pay off debt, or go on a dream vacation. Having specific goals can help you stay motivated and focused on your earnings growth journey.

Create a Budget

With your expenses tracked and financial goals in mind, it’s time to create a budget. A budget is a financial roadmap that helps you allocate your money wisely. Start by listing your income and subtracting your fixed expenses, such as rent or mortgage payments, utilities, and loan repayments. Then, allocate funds for variable expenses like groceries, transportation, and entertainment.

Review and Adjust Your Budget Regularly

Budgeting is not a one-time task. To ensure your budget is effective, review and adjust it regularly. Life circumstances and priorities may change, so your budget should adapt accordingly. Set aside time once a month to evaluate your spending habits, identify areas where you can cut back, and make necessary adjustments. By continuously reviewing and adjusting your budget, you’ll be on the path to achieving your financial goals.

Maximize Earnings with Multiple Side Hustles

Combine Multiple Ideas

If you want to maximize your earnings, consider combining multiple side hustles. This allows you to diversify your income streams and increase your overall earning potential. For example, you can combine freelance writing with selling crafts online, or virtual assistant work with participating in focus groups. By exploring different side hustle options and combining them strategically, you can maximize your earnings and reach your financial goals faster.

Identify Your Skills and Interests

To find the most suitable side hustles for you, start by identifying your skills and interests. Are you good at writing, graphic design, or social media management? Do you have a passion for photography, baking, or tutoring? Consider how you can leverage these skills and interests to earn extra income. By choosing side hustles that align with your strengths and passions, you’ll be more motivated and likely to succeed.

Research Side Hustle Opportunities

Once you have identified your skills and interests, it’s time to research side hustle opportunities. Look for reputable websites, online platforms, or local businesses that offer opportunities in your chosen field. Read reviews and testimonials from other freelancers or side hustlers to ensure you’re signing up for legitimate opportunities. Take your time to explore different options and find the ones that offer the best earning potential and work-life balance for you.

Create a Plan for Each Side Hustle

To effectively manage multiple side hustles, it’s important to create a plan for each one. Determine how many hours you can dedicate to each side hustle and set specific goals for earning and growth. Break down your tasks, set deadlines, and create a schedule that allows you to balance your regular job, personal life, and side hustles. By having a clear plan in place, you’ll be able to stay organized and maximize your earning potential.

Leverage the Power of Blogging

Start a Blog

Blogging is a long-term side hustle that can generate passive income over time. To start a blog, choose a niche that you’re passionate about and knowledgeable in. This could be anything from travel and food to technology and personal finance. Select a blogging platform like WordPress or Blogger, and follow the step-by-step instructions to set up your blog. Choose a visually appealing theme and customize it to reflect your personal brand.

Choose a Niche

Choosing a niche is essential for a successful blog. Find a topic that you’re passionate about and have unique insights or experiences to share. It’s important to select a niche that has a target audience and potential for monetization. Conduct research to determine if there’s an audience interested in your chosen niche and if there are potential opportunities to earn money through sponsored posts, affiliate marketing, or selling digital products.

Create Engaging Content

To attract readers and keep them coming back to your blog, create engaging content. Write informative and entertaining articles that provide value to your audience. Use a conversational tone and inject your personality into your writing. Include high-quality images, videos, or infographics to enhance the visual appeal of your blog posts. Regularly update your blog with fresh content to keep your audience engaged and increase your chances of monetizing your blog.

Monetize Your Blog

Once you have built a loyal readership and established a strong online presence, it’s time to monetize your blog. There are several ways to generate income from your blog, including sponsored posts, affiliate marketing, display advertising, and selling your own products or services. Research different monetization strategies and choose the ones that align with your blogging niche and audience. Remember, monetizing a blog takes time and consistency, so be patient and continue to create valuable content.

Earn Money with Paid Surveys and Focus Groups

Search for Legitimate Survey Sites

One way to earn extra money is by participating in paid surveys. However, not all survey sites are legitimate, so it’s important to do your research. Look for reputable survey sites that have positive reviews and a history of paying participants on time. Avoid sites that require you to pay a fee to join or promise unrealistic earnings. Some well-known legitimate survey sites include Swagbucks, Survey Junkie, and Vindale Research.

Sign Up for Focus Group Opportunities

In addition to paid surveys, another way to earn money is by participating in focus groups. Focus groups typically involve providing feedback and opinions on products, services, or marketing campaigns. Companies often conduct focus groups to gather insights and make informed business decisions. Research reputable market research companies that offer focus group opportunities. Sign up and complete a profile so you can be matched with relevant focus group opportunities.

Optimize Your Time and Effort

To maximize your earnings from paid surveys and focus groups, it’s important to optimize your time and effort. Set aside dedicated time each day or week to complete surveys or participate in focus groups. Be selective about the opportunities you pursue and focus on those that offer higher payouts or have a higher chance of leading to additional opportunities. Be consistent and diligent in completing surveys or participating in focus groups to increase your earnings potential.

Cash Out Your Earnings

Once you have accumulated a certain amount of earnings from paid surveys and focus groups, make sure to cash out. Each survey site or market research company will have its own payout threshold and payment methods. Ensure that you understand the payout process and any associated fees. Choose the payment method that is most convenient for you, whether it’s PayPal, gift cards, or direct deposit. Cash out regularly to enjoy the fruits of your survey and focus group efforts.

This image is property of www.brooksconkle.com.

Become a Virtual Assistant

Develop Relevant Skills

Becoming a virtual assistant is a flexible and in-demand side hustle. To succeed as a virtual assistant, it’s important to develop relevant skills. These may include administrative tasks, social media management, content creation, scheduling, email management, customer service, or graphic design. Identify the skills that align with your strengths and interests, and invest time in developing them through online courses, tutorials, or hands-on experience.

Identify Potential Clients

Once you have honed your skills as a virtual assistant, it’s time to identify potential clients. Consider the types of tasks or services you can offer and the industries or individuals who may require assistance. Reach out to small businesses, entrepreneurs, bloggers, coaches, or professionals in your chosen field. Utilize online platforms, such as Upwork or Freelancer, to find clients or join virtual assistant communities to network and learn from experienced professionals.

Create a Portfolio

To showcase your skills and attract potential clients, create a portfolio as a virtual assistant. Include examples of your previous work, testimonials from satisfied clients, and a comprehensive list of the services you offer. Design a visually appealing and professional portfolio website or create a PDF document that can be easily shared with potential clients. Update your portfolio regularly to reflect your growth and include any new skills or experiences.

Set Competitive Rates

When determining your rates as a virtual assistant, it’s important to strike a balance between your skills, experience, and the current market rates. Research the average rates for virtual assistant services in your industry and location. Consider your level of expertise, the complexity of the tasks you offer, and the value you bring to your clients. Start with competitive rates that reflect your skills and gradually raise them as you gain more experience and positive feedback from clients.

Freelancing as a Lucrative Side Job

Identify Your Freelancing Niche

Freelancing offers endless opportunities to turn your skills and expertise into a lucrative side job. Start by identifying your freelancing niche – the area in which you excel and have a strong passion. This could be anything from web development and graphic design to writing and translation. By focusing on a specific niche, you can position yourself as an expert and attract high-paying clients.

Build a Portfolio

To showcase your freelancing skills, it’s important to build a portfolio that highlights your best work. Create a professional website or online portfolio that showcases examples of your previous projects. Include a brief description of each project, the client you worked with, and the outcomes achieved. Make sure your portfolio reflects the type of work you want to attract in the future and regularly update it with your latest projects.

Market Your Services

One of the keys to freelancing success is effective marketing. Don’t wait for clients to come to you; instead, proactively market your services. Utilize social media platforms like LinkedIn, Twitter, and Instagram to showcase your expertise, share your portfolio, and connect with potential clients. Consider creating a professional blog or contributing guest posts to relevant publications. Attend industry events or join professional associations to network and establish connections with potential clients.

Set Your Rates

Setting competitive rates as a freelancer requires careful consideration. Research the average rates in your industry and location to ensure that you’re charging a fair price for your services. Take into account your experience, expertise, and the value you provide to your clients. Don’t undervalue yourself or your skills, but also be mindful of pricing yourself out of the market. Continuously evaluate and adjust your rates as you gain more experience and build a strong reputation in your industry.

This image is property of www.brooksconkle.com.

Boost Earnings with Cashback Apps

Research and Compare Cashback Apps

Cashback apps are a simple and effective way to boost your earnings while making everyday purchases. Start by researching and comparing different cashback apps available in your country or region. Read reviews, compare the features and benefits of each app, and consider the earning potential and payout options. Look for apps that partner with a wide range of retailers to maximize your earning opportunities.

Link Your Accounts

After selecting a cashback app, it’s important to link your accounts to start earning cashback on your purchases. Connect your bank accounts, credit cards, or loyalty cards to the cashback app as per the app’s instructions. Ensure that your accounts are securely linked and that you understand the privacy and data security measures put in place by the app provider.

Shop and Earn Cashback

Once your accounts are linked, shop as you normally would, but remember to use the cashback app to make your purchases. Before making a purchase, check the app to see if the retailer you’re buying from is listed and what percentage of cashback you can earn. Some cashback apps also offer special promotions or increased cashback rates for certain retailers or product categories. Always be mindful of any terms and conditions associated with earning cashback.

Withdraw Your Earnings

Once you have accumulated a certain amount of cashback, you can withdraw your earnings. Most cashback apps offer various withdrawal options, such as direct deposit, PayPal transfer, or gift cards. Choose the option that best suits your needs and preferences. Some apps may have a minimum withdrawal threshold, so make sure to check the requirements before attempting to withdraw your earnings.

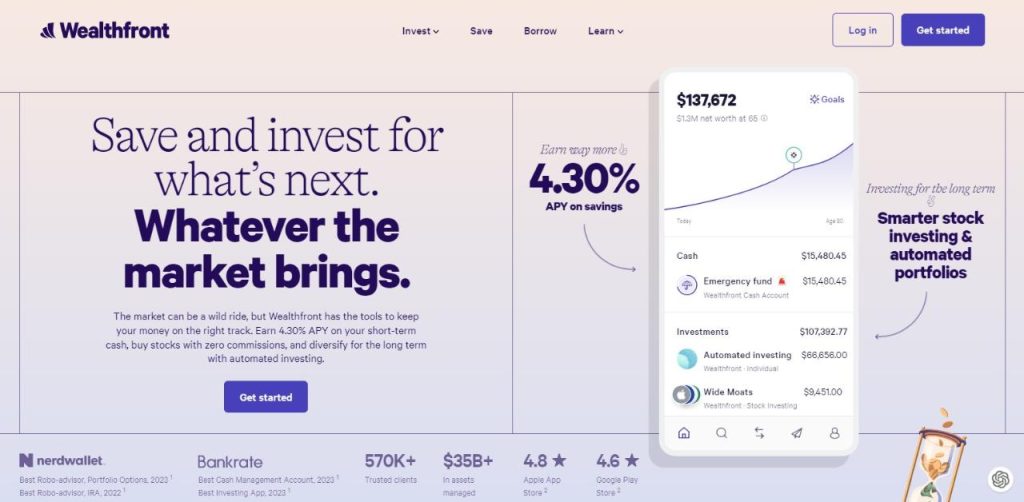

Collect Sign-Up and Referral Bonuses

Discover App Sign-Up Bonuses

Many apps and online services offer sign-up bonuses as an incentive for new users. Take advantage of these sign-up bonuses to boost your earnings. Research apps in various categories, such as delivery services, ride-sharing platforms, online marketplaces, or personal finance apps. Look for apps that offer sign-up bonuses to new users and ensure that you meet the eligibility requirements to receive the bonus.

Share Referral Codes with Friends

Referral codes are promotional codes provided by apps or online services that you can share with your friends and family. When someone signs up using your referral code, both you and the person who signed up can earn bonuses or rewards. Take advantage of these referral programs by sharing your codes with your network. Utilize social media, email, or word of mouth to spread the word and maximize your referral earnings.

Refer Others to Earn Bonuses

In addition to sharing referral codes, some apps and online services offer referral programs where you can earn bonuses by referring others to use the service. These bonuses can vary in amount and form, such as cash rewards, discounts, or freebies. Leverage your network and connections to refer others to the apps or services you use, and take advantage of the referral programs to earn extra money.

Redeem Your Bonuses

Once you have accumulated sign-up and referral bonuses, make sure to redeem them. Follow the instructions provided by the app or online service to claim your bonuses. Some bonuses may be automatically applied to your account, while others may require you to enter a code or reach a certain threshold. Stay organized and keep track of your bonuses to ensure you don’t miss out on any earnings.

This image is property of www.brooksconkle.com.

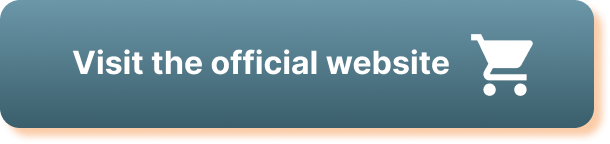

Investing and Budgeting for Long-Term Financial Growth

Educate Yourself on Investing

Investing is a powerful tool for long-term financial growth. If you’re new to investing, it’s important to educate yourself on the basics. Read books, attend seminars, or take online courses on investing to understand concepts like stocks, bonds, mutual funds, and diversification. Learn about different investment strategies and risk management techniques. The more knowledge you have, the better equipped you’ll be to make informed investment decisions.

Set Financial Goals for Investing

Before you start investing, set clear financial goals. Determine your investment timeline – whether it’s short-term, medium-term, or long-term. Are you investing for retirement, a down payment on a house, or your children’s education? Define your risk tolerance and the rate of return you’re aiming for. Having specific goals will help you choose the right investment opportunities and create an investment plan tailored to your needs.

Diversify Your Investment Portfolio

To mitigate risk and maximize returns, it’s important to diversify your investment portfolio. Instead of putting all your eggs in one basket, spread your investments across different asset classes, industries, and regions. Consider investing in a mix of stocks, bonds, mutual funds, real estate, or other investment vehicles. Diversification can help protect your investments from market volatility and increase the potential for long-term growth.

Monitor and Adjust Your Investments

Investing is not a set-it-and-forget-it strategy. Regularly monitor the performance of your investments and make adjustments as needed. Stay informed about market trends, economic indicators, and changes in the industries or companies you have invested in. Review your investment portfolio periodically and rebalance if necessary to maintain your desired asset allocation. Seek professional advice when needed to ensure you’re making sound investment decisions.

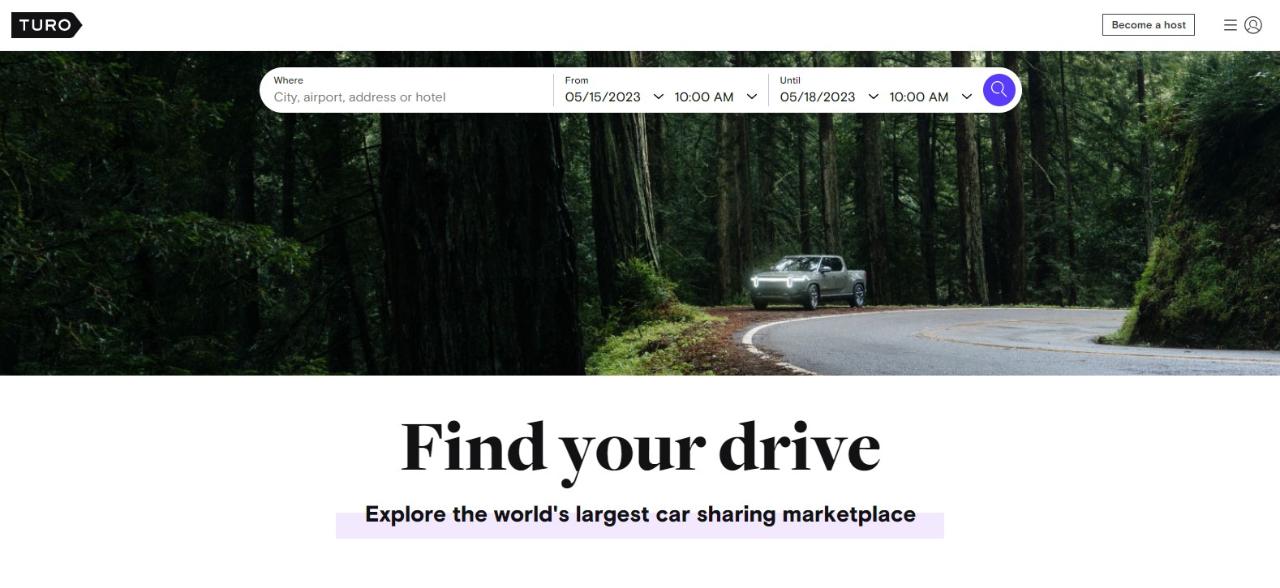

Sell Crafts Online for Extra Income

Identify Marketable Craft Products

If you’re skilled in crafting or have a creative talent, consider selling your crafts online for extra income. Start by identifying craft products that have a market demand. Research popular trends, visit online marketplaces like Etsy or Amazon Handmade, and browse social media platforms for inspiration. Look for unique or niche craft products that can stand out from the competition and attract potential buyers.

Set Up an Online Store

To sell your crafts online, it’s important to set up an online store. Choose an e-commerce platform that suits your needs and budget, such as Shopify, Etsy, or WooCommerce. Create a visually appealing store design that aligns with your brand and showcases your craft products in the best possible way. Include detailed product descriptions, high-quality images, and any additional information that potential buyers may find helpful.

Market Your Crafts

To attract customers and generate sales, you need to effectively market your crafts. Utilize social media platforms like Facebook, Instagram, or Pinterest to create a strong online presence. Share high-quality photos of your crafts, engage with your target audience, and share stories or behind-the-scenes content. Consider collaborating with influencers or bloggers in your niche to expand your reach. Word-of-mouth marketing is also powerful, so encourage satisfied customers to leave reviews or recommend your crafts to others.

Fulfill Orders and Provide Excellent Customer Service

As your crafts gain popularity and orders start rolling in, it’s important to fulfill them timely and provide excellent customer service. Communicate promptly with customers, answer any questions or concerns they may have, and provide updates on the progress of their orders. Pay attention to packaging and shipping to ensure your crafts arrive in perfect condition. Aim to exceed customer expectations and leave a lasting positive impression to encourage repeat business and referrals.

By implementing these strategies, you can create a comprehensive plan and budget for earnings growth. Whether it’s through side hustles, blogging, surveys, freelancing, cashback apps, or investing, there are numerous opportunities to increase your income and achieve your financial goals. Remember to stay consistent, be adaptable to changes, and continuously evaluate and adjust your approach. With determination and a friendly tone, you can turn your financial aspirations into reality.

Source: https://www.brooksconkle.com/how-to-make-1000-a-week/