Are you struggling with energy debt? Don’t worry, there are steps you can take to speak, seek, and save. It’s crucial to reach out to your energy supplier as soon as possible if you’re having trouble paying your bills. They are obligated to work with you and negotiate a payment plan that fits your budget. However, if you can’t come to an agreement, it’s advisable to seek advice from a reputable debt charity. Additionally, making your home more energy efficient can help reduce your energy costs. Just remember to keep your home warm enough to prevent dampness and illness. If you need further assistance, our consumer service is here to help.

Speak to your energy supplier

If you’re struggling to afford your energy bills, it’s important to speak to your energy supplier as soon as possible. They are obligated to help you find a solution and negotiate a payment plan that works for both parties. When creating a payment plan, your supplier must take into account your ability to pay and your future energy usage. Through a payment plan, you will make fixed payments towards your debt over a set period of time. Remember, the sooner you reach out to your energy supplier, the sooner you can find a resolution.

Payment plan options

When discussing a payment plan with your energy supplier, there are several options available to consider. These options can help alleviate the financial burden and make it more manageable for you to repay your debt. Some common payment plan options include spreading the outstanding debt over a series of monthly payments, setting a fixed monthly amount to be paid towards the debt until it is fully repaid, or negotiating a temporary reduction in payments while you work towards improving your financial situation. Your energy supplier will work with you to determine the best option based on your specific circumstances.

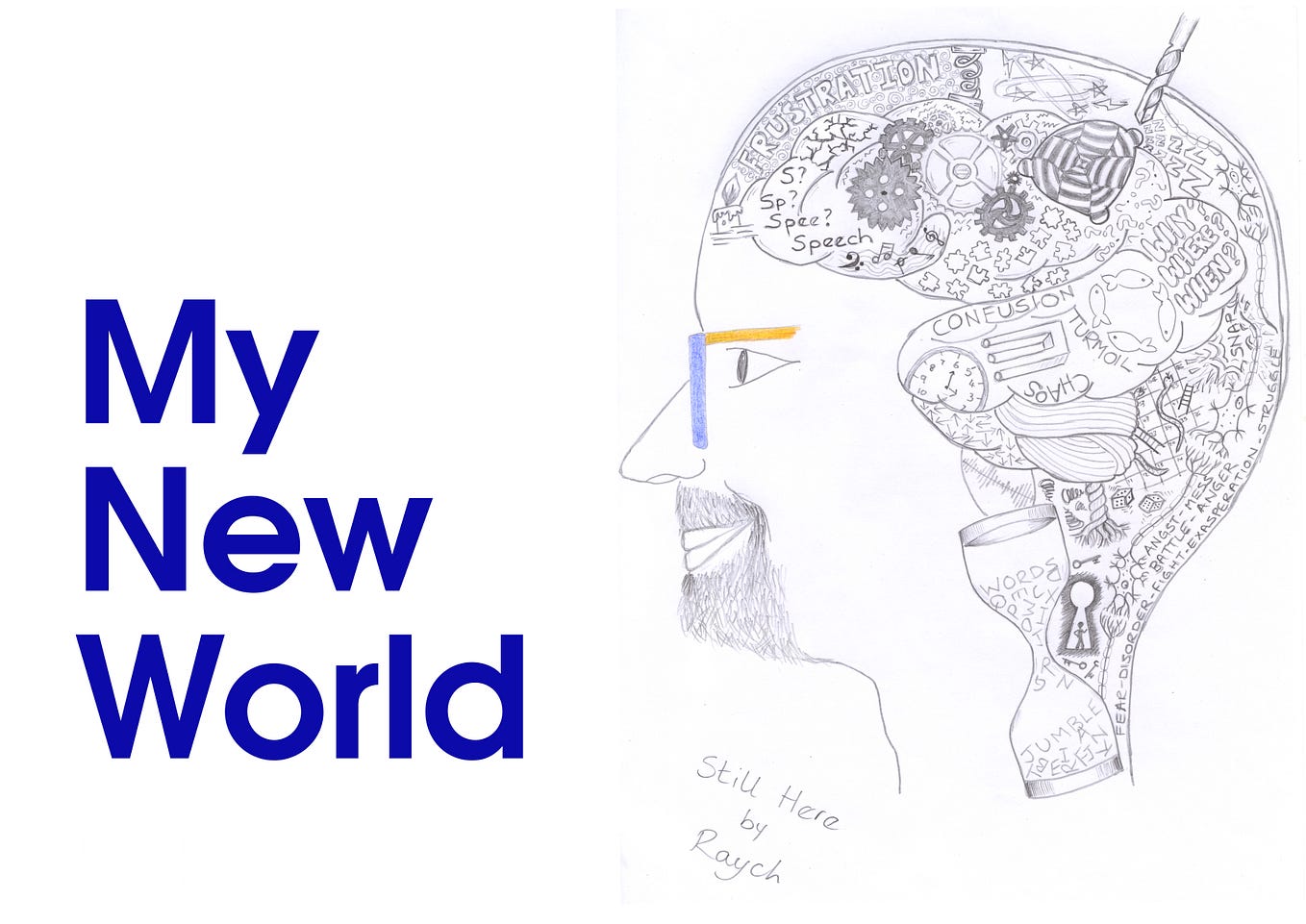

This image is property of miro.medium.com.

Get help from consumer advisers if you can’t reach an agreement

If you find it difficult to reach an agreement with your energy supplier regarding your debt repayment, don’t hesitate to seek assistance from consumer advisers. These professionals are trained to provide guidance and support in navigating complex financial situations. They can help you understand your rights, explore alternative options, and mediate between you and your energy supplier to find a resolution. It’s important to remember that you don’t have to face this challenge alone – there are resources available to help you overcome it.

Seek advice on managing debt

Debt related to energy bills is considered a priority debt, meaning it should be addressed promptly. Seeking advice from a reputable debt charity or organization is crucial to effectively manage the debt and prevent it from escalating further. A debt charity can provide you with long-term strategies to reduce your debt and regain control of your finances. However, it’s important to be cautious when seeking debt advice, as not all sources may be trustworthy. To ensure you’re receiving reliable advice, you can use the StepChange checklist, which helps you verify the credibility of the advice you’re receiving. Some national providers of free debt advice include Citizens Advice, StepChange, and the National Debtline.

This image is property of miro.medium.com.

Importance of seeking advice for energy bill debt

When facing energy bill debt, seeking advice is crucial for several reasons. Firstly, debt advice can help you understand your rights and options, empowering you to make informed decisions about your financial situation. Secondly, debt advisers can provide guidance on budgeting, prioritizing debt payments, and negotiating with creditors. Thirdly, they can help you explore potential debt solutions, such as debt management plans or debt relief orders, to find the most suitable and sustainable path towards debt resolution. By seeking advice, you can regain control of your finances and work towards a debt-free future.

Debt charity assistance

Debt charities play a vital role in assisting individuals with managing their debt, including energy bill debt. These charities offer free and confidential support, providing individuals with the tools and knowledge they need to navigate their financial difficulties. Debt charity assistance includes budgeting advice, negotiations with creditors, and guidance on debt solutions. By seeking assistance from a debt charity, you can access expert advice tailored to your specific needs, helping you overcome your energy bill debt and achieve financial stability.

This image is property of miro.medium.com.

Using the StepChange checklist

The StepChange checklist is a valuable resource that can help you ensure you’re receiving reliable and trustworthy debt advice. It provides a series of questions to ask yourself and the debt adviser to assess the legitimacy of the advice being given. Some key questions on the checklist include verifying the qualifications and accreditation of the adviser, understanding the fees and charges involved, and confirming the organization’s reputation and track record. By using the StepChange checklist, you can feel confident in the advice you receive and make informed decisions about your debt management strategy.

National providers of free debt advice

For those in need of free debt advice, there are several national providers available to offer support. Citizens Advice, StepChange, and the National Debtline are reputable organizations that specialize in providing expert debt advice. These organizations have trained advisers who can help you understand your options, negotiate with creditors, and create a plan to manage your debts effectively. By reaching out to one of these national providers, you can access the assistance needed to tackle your energy bill debt and take control of your financial future.

This image is property of miro.medium.com.

Save energy by making your home energy efficient

Making your home energy efficient is not only beneficial for the environment, but it can also help you reduce your energy bills. By implementing simple changes around your home, you can make a significant impact on your energy consumption. Some examples of these changes include checking your central heating system for efficiency, using appliances more efficiently, and insulating your home to retain heat. These small adjustments can add up to significant savings over time.

Assistance for larger energy efficiency changes

In addition to making small changes, there may be assistance available for larger energy efficiency improvements in your home. This could include upgrading to a more energy-efficient heating system, installing insulation, or replacing old appliances with energy-saving models. Many governments and organizations offer financial incentives, grants, or low-interest loans to help homeowners make these upgrades. By taking advantage of these programs, you can make more substantial improvements to your home’s energy efficiency, saving even more on your energy bills.

This image is property of miro.medium.com.

Importance of maintaining warmth and essential appliances

While it’s important to be mindful of energy consumption, it’s equally important to maintain warmth and ensure essential appliances are in working order. Keeping your home at a comfortable temperature helps prevent dampness, mold, and potential health issues. It’s also vital to keep essential appliances, such as your refrigerator, functioning properly to prevent food spoilage and additional expenses. Balancing energy conservation with maintaining a comfortable and functional living environment is key to achieving optimal energy efficiency.

Contact the consumer service for additional help

If you’re still struggling to afford your energy bills or have difficulties reaching an agreement with your energy supplier, don’t hesitate to contact the consumer service for additional help. They can provide further assistance and guidance tailored to your specific situation. By reaching out to the consumer service, you can access the support needed to navigate through challenging energy bill situations and find a resolution that works for you.

Struggling to afford energy bills

If you’re finding it challenging to afford your energy bills, it’s essential to seek help as soon as possible. The consumer service can provide guidance on available financial assistance programs, payment plans, and energy-saving strategies. They can also help you explore options for reducing your energy consumption and lowering your bills. Remember, you’re not alone in this situation, and there are resources available to support you.

Difficulties in reaching agreement with supplier

If you’re having difficulties reaching an agreement with your energy supplier regarding your debt repayment or payment plan, the consumer service can intervene and help mediate the situation. They can provide advice on your rights as a consumer and help you negotiate a mutually agreeable resolution. Their expertise and experience in dealing with energy-related issues can be invaluable in finding a fair and sustainable solution.

Contact information

If you need to contact the consumer service for additional help or information, you can reach them at the following number:

- Call 0808 223 1133 (Monday to Friday, 9am to 5pm)

Calls to this number are free from both mobiles and landlines. The consumer service advisers are trained professionals who are ready to listen to your concerns and provide the necessary support and guidance you need.

Useful links

For more information on energy advice and support, you can visit the following websites:

- Citizens Advice energy advice

- Help with the cost of energy efficiency

- StepChange checklist for debt advice

- Energy saving tips for your home

- The National Debtline

- Advice Direct Scotland

These resources provide a wealth of information and resources to help you manage your energy bills and debt effectively. Whether you’re looking for energy-saving tips, debt advice, or financial assistance programs, these links can point you in the right direction.

The importance of speaking to your energy supplier

When facing difficulties in affording your energy bills, it’s crucial to speak to your energy supplier as soon as possible. By reaching out to them, you open the door to potential solutions and payment plans that can help alleviate the financial burden. Your energy supplier has a duty to assist you and work towards a mutually agreeable solution. Don’t hesitate to take the first step and communicate with your energy supplier – it’s the first step towards finding a resolution.

Types of payment plans available

When discussing a payment plan with your energy supplier, there are several options to consider. Spreading the outstanding debt over a series of monthly payments, setting a fixed monthly amount, or negotiating a temporary reduction in payments are common options. These payment plans provide structure and clarity, making it easier for you to manage your debt and budget your finances effectively. By understanding the types of payment plans available, you can work with your energy supplier to find the most suitable option for your situation.

Seeking assistance from consumer advisers

If reaching an agreement with your energy supplier seems challenging, consumer advisers can provide valuable assistance. These professionals are equipped with the necessary knowledge and tools to help you navigate complex debt situations. They can provide guidance on your rights as a consumer, negotiate on your behalf, and help you explore alternative solutions. Seeking assistance from consumer advisers can give you the confidence and support needed to find a fair resolution to your debt.

Understanding the priority of energy bill debt

Energy bill debt is considered a priority debt, meaning it should be addressed promptly. Failing to pay your energy bills can have serious consequences, such as disconnection of services or legal action. It’s essential to prioritize your energy bill debt and seek assistance as soon as possible. By understanding the importance of addressing energy bill debt, you can take the necessary steps to prevent further financial hardship and find a solution that works for you.

Contact information for consumer service

If you’re facing challenges with your energy bills or struggling to reach an agreement with your supplier, don’t hesitate to contact the consumer service for additional help. They can provide guidance, support, and advocacy to ensure your rights as a consumer are protected. The contact information for the consumer service is as follows:

- Call 0808 223 1133 (Monday to Friday, 9am to 5pm)

By reaching out to the consumer service, you can access the support and assistance needed to overcome your energy bill challenges and find a resolution that works for you.

Source: https://wearecitizensadvice.org.uk/are-you-in-energy-debt-speak-seek-save-06c60f878eb6